December 21, 2023

Find the Best Mortgage Broker: Your Ultimate Guide

Finding your dream home can be thrilling, but navigating the maze of mortgage options? That's where things get tricky. You need a guiding hand, and that's where a mortgage broker comes in.

They're your ally in the home-buying battle, ready to secure the best rates and terms tailored just for you.

In this ultimate guide, you'll uncover the secrets to finding top-notch mortgage broker services that can make your home-buying experience as smooth as silk.

You'll learn what to look for, the right questions to ask, and how to ensure you're partnering with a broker who has your best interests at heart.

What is a Mortgage Broker?

When you're on the hunt for your dream home, navigating through the labyrinth of mortgage products on your own can be daunting. A mortgage broker is a specialist who acts as an intermediary between you and potential lenders.

Their role is crucial in finding a mortgage that fits your financial situation and securing competitive interest rates. Mortgage brokers have a broad knowledge of the mortgage market.

They maintain relationships with a multitude of lenders, from major banks to niche financial institutions, which means they can offer you a wider selection of loan options than you might find on your own.

This array of choices is particularly beneficial as it can cater to a diverse range of needs - whether you're a first-time buyer, looking to refinance, or an investor.

Benefits of Using a Mortgage Broker

1. Expert Advice and Guidance

When you're navigating the vast ocean of mortgage options, expert advice and guidance are invaluable.

A mortgage broker brings to the table years of industry experience, providing you with insights and recommendations tailored to your unique financial situation.

They're equipped with a deep understanding of lending criteria and can navigate complex mortgage jargon, translating it into plain English.

This means you're less likely to encounter surprises during the mortgage process and more likely to secure a deal that aligns with your long-term objectives.

2. Access to a Wide Range of Lenders

Mortgage brokers maintain relationships with a multitude of lenders, from big banks to niche financial institutions.

Their accessibility to a broad spectrum of loan products increases your chances of finding the ideal match for your borrowing needs.

With a broker, you're not limited to the offerings of a single lender; you’re exposed to a diverse range that spans various interest rates, loan terms, and repayment options that might otherwise be beyond reach.

3. Time and Cost Savings

The journey to your dream home can be lined with time-consuming hurdles and hidden expenses. By enlisting a mortgage broker, you steer clear of the legwork involved in loan comparison and application processes.

Brokers not only find competitive rates but also often have the inside track on special deals and can negotiate terms on your behalf. This can result in significant time and cost savings for you.

Given the complex nature of mortgage applications, a broker’s ability to streamline the process is a crucial advantage that can save you both time and money.

Remember, when choosing a broker, consider their familiarity with the market, customer testimonials, and transparency about their fee structure to ensure your journey to homeownership is a smooth one.

How to Find a Mortgage Broker

1. Ask for Recommendations

Leveraging personal networks can simplify your search for a mortgage broker. Family, friends, or colleagues who've recently purchased a property might have valuable insights and recommendations.

Real estate agents, who interact with mortgage brokers regularly, are also a rich source of referrals.

Inquire about the broker's communication style

Note down if the broker exceeded client expectations

Gather details on the broker's market knowledge

With these insights, you'll have a practical base from which to start your search.

2. Do Online Research

The internet is vast, and a treasure trove of information lies at your fingertips. Start by searching for mortgage brokers in your area and scrutinize their online presence.

Look at reviews on independent websites

Study their professional profiles on platforms like LinkedIn

Explore forums for unbiased opinions

Assess their website for a comprehensive service list

Ensure that you’re checking for a consistent track record of satisfied clients. Remember, the quality of the online content reflects a broker's professionalism and attention to detail.

3. Check Credentials and Licensing

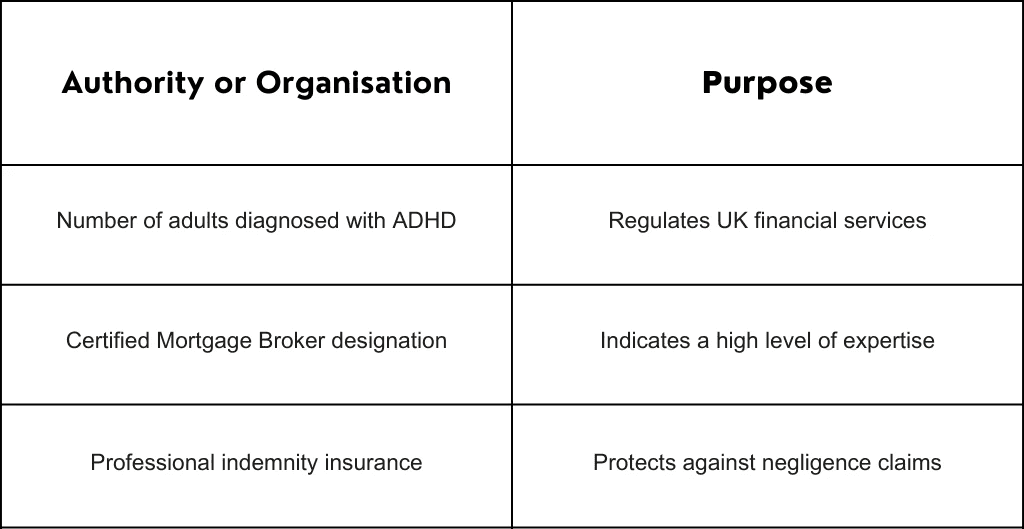

Verifying credentials is non-negotiable. A competent mortgage broker should have the necessary qualifications and adhere to relevant regulatory requirements.

Confirm membership with industry bodies

Check for any disciplinary actions or complaints

Review their experience and specialization

A licensed broker with a clean history and sound credentials is more likely to guide you through the mortgage process successfully.

Questions to Ask a Mortgage Broker

When you meet with a mortgage broker, it's essential to arm yourself with the right questions to determine if they're the perfect fit for your needs.

Asking the right questions can shed light on the broker's expertise, services, and how they can assist you in securing the best mortgage deal.

1. What Types of Mortgages Do You Offer?

Firstly, enquire about the variety of mortgage products the broker has within their portfolio.

A comprehensive range of options signifies that they can tailor solutions to your unique financial circumstances:

Fixed-rate mortgages

Variable-rate mortgages

Interest-only mortgages

Tracker mortgages

Establish whether they offer government-backed programs like Help to Buy schemes or if they're focused solely on traditional mortgage products. The broader the selection, the better chance you have at finding a mortgage that's optimal for you.

2. What Are Your Fees and Commission Rates?

Understanding how a mortgage broker gets paid is crucial in assessing the transparency and fairness of their services. Brokers typically earn through fees paid by you, the client, or through commissions from lenders.

Clarify these details upfront:

Brokerage fees

Application fees

Commission percentages

Ask for a breakdown of all potential costs to avoid unexpected charges later on. An honest mortgage broker will be upfront about their payment structure, allowing you to budget accordingly.

3. How Do You Determine Which Lender Is Best for Me?

Your broker should have a methodical approach to matching you with a suitable lender.

It's not just about the lowest interest rate; they should also consider factors like:

Loan terms

Repayment penalties

Lender's customer service

Ask them about the criteria they use and how they weigh various lender attributes against your financial situation. A broker that asks detailed questions about your finances and goals is likely to provide a service that's truly customized to your needs.

Remember, an ideal mortgage broker will prioritize your interests over merely selling you a product.

Steps in the Mortgage Broker Services Process

Engaging a mortgage broker can streamline your journey to homeownership or investment. Understanding the steps involved in their service process will equip you with the knowledge to navigate this path.

1. Initial Consultation

Your first interaction with a mortgage broker is elemental in setting the stage for what follows. In the initial consultation, you'll discuss your financial situation, property goals, and any concerns you might have.

A competent broker will assess your needs and provide insights on the market trends and available mortgage products.

This meeting is also an excellent opportunity to ask those critical questions about fees, processes, and what to expect in the coming weeks. Ensure you're prepared to share your financial history so the broker can offer tailored advice.

2. Mortgage Application

Once you've reviewed your options and have selected a mortgage product that suits your needs, it's time to press on to the application process. Here the broker will help you fill out the necessary forms and handle the submission to potential lenders.

It's a meticulous process, and accuracy is vital to avoid setbacks or delays. Your broker's expertise becomes invaluable as they can preempt issues and ensure your application presents your case compellingly.

3. Documentation and Verification

After your application is lodged, you'll be required to provide a series of documents to support your financial claims. These might include proof of income, bank statements, or proof of assets and liabilities.

Your broker will guide you through gathering the correct documents and liaise with the lender on your behalf. The importance of submitting complete and accurate documentation cannot be overstated as it’s often the linchpin in the approval process.

4. Loan Approval and Closing

The final stretch starts when your loan application receives a nod of provisional approval. At this stage, the lender might request additional information or clarifications. With your broker's help, you'll navigate these requests to achieve a formal approval.

Once approved, your broker will facilitate the closing process, which includes reviewing the loan contract, coordinating with solicitors or conveyancers, and ensuring all final details are in order.

This phase culminates with the settlement where the loan funds are disbursed, and you can celebrate reaching what is often the ultimate goal – buying a home or securing a property investment.

Tips for a Successful Mortgage Broker Experience

1. Be Prepared

When embarking on your journey with a mortgage broker, being prepared is paramount. Arm yourself with a comprehensive understanding of your financial situation.

You'll need to have your financial documents, such as pay stubs, tax returns, and bank statements, in order. Thorough preparation will expedite the mortgage process and signal to your broker that you're serious and organized.

It also means you'll be equipped to make informed decisions about your mortgage options.

2. Communicate Openly and Honestly

Clear communication with your mortgage broker lays the foundation for a positive outcome. Always share accurate information regarding your finances and goals.

Honesty in this exchange ensures your broker can find a loan that truly fits your needs. If there are any changes in your financial situation or if you have concerns about your loan options, it's crucial to convey these promptly.

Remember, your broker is there to advocate for your best interests, so keeping them in the loop is in your favour.

3. Review and Understand All Documents

Every document in the mortgage process is vital, and it's important to review each one carefully. Ask questions if there's anything you do not fully understand. Your mortgage broker should be happy to clarify or provide additional information.

Understanding the terms and conditions laid out in documents, such as your loan estimate and closing disclosure, can prevent surprises down the road.

Attention to detail in this step not only helps in making smart decisions but also safeguards your financial future.

By following these recommendations, you'll position yourself for a more Streamlined and Satisfying mortgage experience with your chosen broker.

Frequently Asked Questions

1. What should I do to prepare for meeting with a mortgage broker?

Be aware of your financial situation and have all necessary documents, such as proof of income, credit reports, and bank statements, ready for review.

2. How important is communication with my mortgage broker?

Clear and honest communication is essential. You should feel comfortable asking questions and discussing your financial goals to ensure the best mortgage options are found.

3. What types of documents will I need to understand during the mortgage process?

You will need to understand various documents including loan estimates, closing disclosures, and the final loan agreement. Make sure to review these carefully and ask for clarification on anything unclear.

4. Is it necessary to check my credit report before applying for a mortgage?

Yes, checking your credit report is crucial as it affects your loan terms. Identifying and correcting any errors beforehand can improve your chances of getting a favorable mortgage deal.

5. Can I negotiate the terms of my mortgage with my broker?

Absolutely, you should discuss and negotiate the terms of your mortgage. Your broker can help you understand what aspects of the mortgage can be modified to better suit your needs.

Conclusion

Arming yourself with knowledge and maintaining open communication are the cornerstones of navigating the mortgage broker landscape.

Remember, it's about building a partnership that fits your financial needs. By ensuring you're well-prepared and understand the process, you'll be set to make informed decisions with your broker by your side.

Here's to a smoother journey towards your property goals.

This content is for informational purposes only and should not be construed as financial advice. Please consult a professional advisor for specific financial guidance.

Similar articles

February 21, 2025

Established fact that a reader will be distracted by the way readable content.

February 20, 2025

Established fact that a reader will be distracted by the way readable content.

February 19, 2025

Established fact that a reader will be distracted by the way readable content.